Last week marked a big moment in the short history of durable open-system carbon removal. The

announcement of Frontier’s $57M offtake agreement to buy ~150,000 removed tons from Lithos, an

enhanced rock weathering (ERW) supplier, is the world’s first truly large-scale, multi-year

purchase of durable carbon removal via an open-system pathway.

The public reaction to the offtake announcement has included a lot of excitement and also some

apprehension. Fueling the excitement is a cocktail of features and attributes that make ERW

attractive—including uncommonly strong co-benefits, a promising cost trajectory, big economic

opportunities across the Global South, widely-available feedstock, and ability to piggyback on

existing infrastructure1. Some other durable

CDR pathways have some of these features but none combine all of them.

Like any open-system pathway, ERW faces some of the ‘sources of messiness’ we have previously written about

but on some dimensions may have a more moderate case of these2. The biggest source of messiness for ERW—and the subject of

most current public scrutiny—lies in the challenge of rigorously quantifying carbon removal amidst uncertainties. There exists quite a few drivers of uncertainty that require more scientific study and that must be addressed properly in quantifying ERW.

To the extent that some observers are feeling concerned or anxious about the advent of

commercial ERW offtake agreements, the crux question is whether substantial quantification

uncertainty means that the ERW market is getting too far ahead of ERW science. Are defensible,

high-confidence carbon removal claims with ERW possible at this stage? Should we put commercial

offtake activity on ice until we hit certain future milestones in our scientific understanding?

Fork in the Road for the ERW Market

We believe the answer to these questions has more to do with how the commercial activity

happens, rather than whether substantial commercial activity is appropriate. And in turn, the

“how” analysis should have two primary thrusts:

- Can we approach ERW carbon removal quantification with rigor and consistency—measuring what we

can measure, characterizing the remaining uncertainties in a manner reflecting best available

science, and then (critically) discounting sufficiently conservatively to confidently err on

the side of under- rather than overestimating net carbon removal?

- Can we turn commercially-funded ERW deployment into a powerful—perhaps even the most

powerful—avenue to learn by doing and accelerate public scientific understanding of the ERW

pathway?

The natural human tendency will be to render instinctive and binary judgment: substantial early

market activity is either a good thing or a bad thing. But if we’re honest, it’s too soon to

know. The fork in the road between vicious and virtuous cycles in ERW’s future is still in front

of us.

One can easily imagine how a bad movie might play out over the next few years. In this variant

of the future, early offtakes signal that ERW is ready for primetime in a way that quickly draws

in new buyers and suppliers. More companies with logistical capability and access to alkaline

feedstock start saying “I’ve got rock and will spread it on fields if you’ll pay me,” and the

market starts to flood with low-quality, low-price ERW supply. Accordingly, it would become

increasingly commonplace for ERW deployment to proceed with minimal rigor in quantification

practices. Even suppliers capable of high-quality supply might end up getting caught up in

race-to-the-bottom dynamics, cutting corners with their MRV practices and lowballing the

discounts they apply to key sources of uncertainty in order to compete on price. Meanwhile, in a

cutthroat environment with suppliers focused on fighting over pieces of the pie more than

growing it, data from commercial deployments might well stay entirely locked up behind closed

doors.

If this scenario were to materialize, carbon removal claims made on the basis of insufficient

measurement and dubious treatment of uncertainty will not stand up to scrutiny—or there might be

no mechanism for public scrutiny to begin with. Accelerating erosion of public trust would

accelerate amidst negative media coverage and a growing backlash amongst skeptical farmers,

scientific researchers, and policymakers. With minimal access to data from commercial

deployments, market activity would not succeed in boosting the pace of public learning about ERW

and to chip away at its attendant uncertainties. To the extent that the ERW field starts to

unravel, it could poison the well for open-system carbon removal pathways more generally.

Needless to say, this is a scenario we should do everything in our power to avoid.

Good movie scenario: steering toward a virtuous market cycle

A good-movie scenario could equally well take root with deliberate and collaborative steering by

leading market actors and other stakeholders in the ERW community. What might that look like?

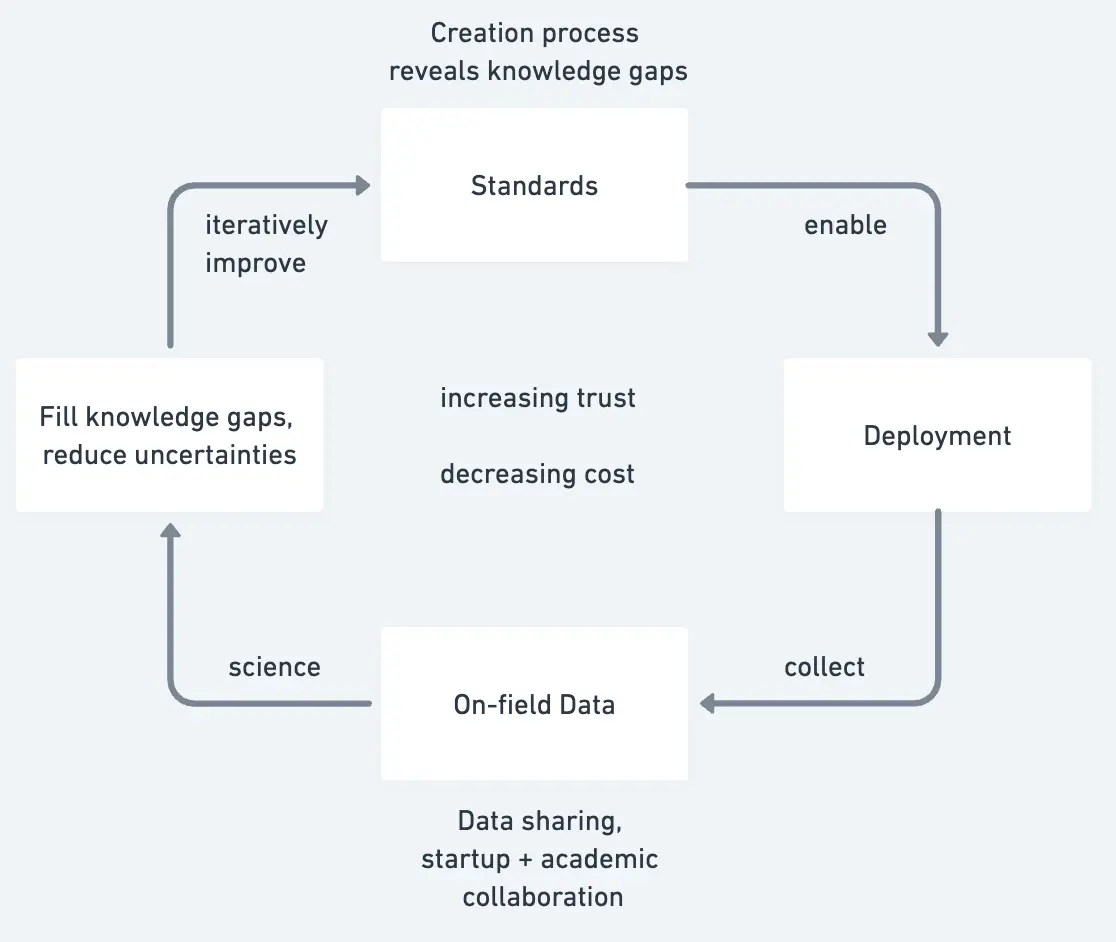

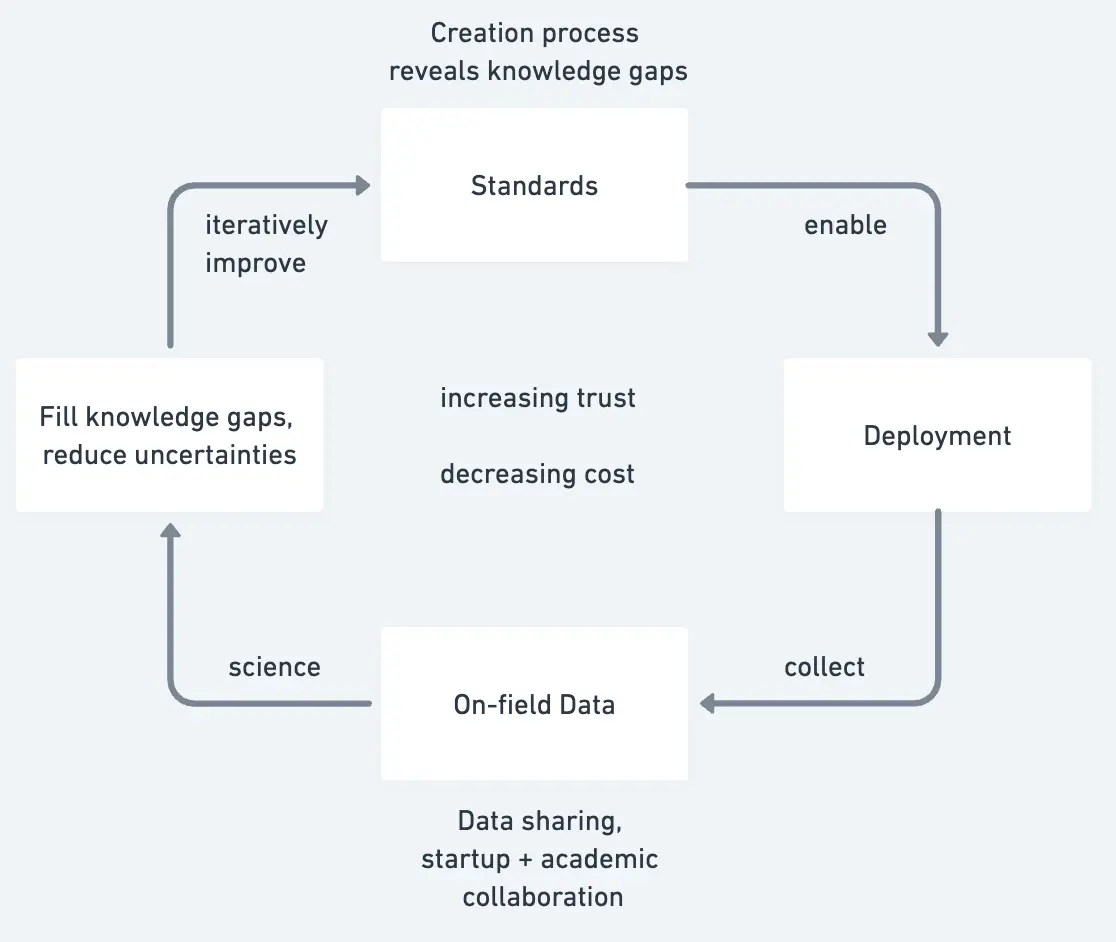

In this version of the future, the first wave of offtake agreements materializes in parallel

with strong market-shaping efforts to establish a very different market cycle and public

narrative. Two market-shaping pillars will be particularly crucial: 1) a dynamic industry-wide quantification standard

for quantifying tons removed via ERW; and 2) a system for data access

that makes it possible both to publicly assess carbon removal claims and to produce new scientific

knowledge using data from commercially-funded deployments. Data access and consistent, rigorous quantification

are not nice-to-have features for the ERW market—they are the lifeblood of public trust and scientific

learning and we need to bake them into the market’s foundation.

As these and other new collective arrangements get developed, early ERW buyers can use the full

extent of their leverage to help them take root in the market, purchasing only from suppliers

and registries that agree to participate. Even before such industry-wide arrangements have

materialized, Frontier and Lithos have started to show the way down that path by including in

their offtake contract provisions for select public data sharing, using open-access rubrics to assess quality and environmental-impact considerations, and more.

By deploying their power to shape the market, early buyers can help ensure that burgeoning

market activity and offtake agreements get harnessed for the public interest. And in following

Frontier’s example by showing willingness to pay prices that reflect all true current costs and

uncertainty sources—including COGS, measurement costs, and uncertainty discounts—early buyers

will be (accurately) seen to be subsidizing the learning-by-doing required to reduce uncertainty

and drive down ERW prices over time. Jigar Shah and others have called this paradigm

“deployment-led innovation,” with the central premise being that the very act of deploying at growing scales is what drives

the most important learning.

Quality and quantification rigor

Much of the scrutiny applied to commercial enhanced weathering activity is due to the fact that

buyers intend to use their purchased carbon removal tons to compensate for their emissions, via

ton-for-ton offsetting. These compensatory claims put a lot of pressure on the early market to

ensure highly rigorous quantification, since overestimating the quantity of carbon removed means

that buyer emissions will not have been fully and truly counterbalanced. As we will explore in

future writing, this challenge/difficulty does raise the question of whether compensatory-claims

demand should be the only—or primary—form of payment for ERW and other open-system in the

earliest years of the market.

At the heart of the quantification challenge is enhanced weathering’s extensive heterogeneity:

diverse rock compositions, baseline soil chemistries, and local climate conditions all

interacting with one another. Quantifying net carbon removal involves combining data from many

different imperfect “windows into the system”—geochemical measurements, tracers, and models—in

seeking to assemble a comprehensive picture of all carbon and cation fluxes as dissolved

alkalinity moves throughout the soil column and into groundwater, river systems, and ultimately

the ocean.

Our goal for the purpose of voluntary carbon removal markets (and even for compensatory claims)

doesn’t need to be quantifying tons removed with perfect accuracy, but rather quantifying tons

removed conservatively enough that the chances of systematic overestimation are negligible. Even

as scientific knowledge about enhanced weathering increases, the system is sufficiently complex

and heterogeneous that we will never eradicate uncertainty. This requires discounting to

conservatively account for known uncertainties (see prior blog post). We need to get comfortable with the notion that persistent and manageable uncertainty in the

system does not necessarily imply significant uncertainty about a conclusion that at least X

tons have been removed.

For a healthy market to develop, it is mission-critical that supplier quantification protocols

fully address each carbon and cation flux within the system following best available science. To

help scaffold consistency and rigor across the market, Cascade is facilitating a process to

develop a Community ERW Quantification Standard. This standard will articulate a set of

high-level requirements to which any supplier protocol must adhere—allowing protocols to vary in

their specifics while creating a strong ‘common core’ as the foundation.This will explicitly be

a “dynamic standard,” meaning that it will be regularly updated over time as more data is

collected across deployments and as science progresses.

Imposing a higher quality bar on ERW quantification will necessarily imply putting upward

pressure on the price per ton sold on the market. Yet this is both healthy and temporary. Fully

reflecting the implications of rigorous MRV and conservative discounting in near-term ERW prices

creates a stronger foundation of quality in the market. ERW can then come down the cost curve in

the coming years, through development of cheaper measurement approaches and growing ability to

accurately model the system. Catalytic buyers like Frontier who are willing to pay higher prices

in the early days unlock the learning-by-doing and innovation that will progressively make

prices more affordable for the mass market.

Data access system

With the first wave of large commercial ERW purchases, the scale of privately-funded deployments

is starting to dramatically outpace the scale of publicly-funded research field trials. This

will produce a state of affairs where the bulk of ERW field data is held, in the first instance,

by commercial suppliers. From our point of view, one of the biggest factors determining whether

large-scale ERW offtakes represent healthy or unhealthy market activity is the extent to which

this privately-collected data is accessible to the scientific community and the public, rather

than locked behind proprietary doors.

Accordingly, our second major initiative at Cascade is to help design and stand up a new data

access system for commercial ERW deployment data. One primary aim of this effort is to help

build public trust in enhanced weathering—both 1) earning the trust of farmers by showing

through public data that it is a safe farming practice that will increase their yields and help

their bottom line; and 2) building public and scientific trust in carbon claims made. Many

carbon removal buyers today are still skeptical of enhanced weathering as a CDR pathway that can

deliver them high-quality tons, and fear backlash if these purchased tons are later deemed bogus

or poorly quantified. To reach sufficient levels of scientific trust in the quantification of

such a complex open system, enough data needs to be shared to enable public reproducibility of

suppliers’ crediting calculations from their deployment data, such that the scientific rigor of

quantification methods can be reviewed, evaluated, and collaboratively improved by members of

the scientific community.

A second core way in which data access is critically important is by catalyzing public scientific learning. The primary way we can learn about enhanced weathering is by getting rocks on field and doing substantial

measurement and observation, across heterogeneous baseline conditions. With a commercial data access

system that engenders broad participation and makes data reported by different suppliers interoperable,

this first wave of offtakes can become a massive engine for new learning, uncertainty reduction,

and the development of new and improved quantification methods.

The details of designing a data access system that meets these goals and that gets wide buy-in

across the market will be complex—what data types will be shared, across what fraction of

fields, and with what means of anonymization and aggregation to protect farmer privacy. Even

where such a system creates tension for suppliers whose business model is partly based on

building proprietary data moats, we as a whole field and industry need to shift into a mindset

of massively growing the pie rather than fighting over who gets what slice of the relatively

small existing market. Enabling this long-term growth of the market orders of magnitude beyond

the current small set of early catalytic buyers requires the trust-building and learning that

come with broad data sharing.

A pivotal year

The Community Quantification Standard and new data access system outlined above will launch in

the coming year. If these two market-shaping efforts fail to gain traction, the likelihood of a

bad-movie scenario materializing in coming years will grow.

If 2024 brings widespread adoption of and participation in these community frameworks, we will

have the best shot at a healthy market cycle. Rigorous quantification will give buyers

confidence to engage in offtake agreements, which in turn trigger larger deployments, which in

turn unlock cross-supplier data and peer-reviewed meta-analysis that deepen our knowledge base …

thereby reducing uncertainties, driving down discounts and prices, further enhancing buyer

appetite, and cultivating trust among farmers and the public one step at a time. The new

market-shaping arrangements can also strengthen bridges between ERW suppliers and researchers in

academia and civil society, with opportunities to collaboratively improve suppliers’

quantification methods, MRV protocols, and the community standard itself.

Other market-shaping arrangements are likely to emerge over time, and suppliers can be part of

the vanguard. Both in ERW and beyond, we are already seeing great examples of suppliers taking

the initiative in charting a path with quality and transparency at the heart. The recently

published Reykjavik Protocol is one such example, with a group of suppliers coming together to articulate a wide-ranging set

of shared commitments for responsible deployment and commercialization of carbon removal. The Reykjavik

Protocol incorporates quality and data sharing as core principles that will enable a healthy market

for negative-emissions technologies.

Everyone in the ERW ecosystem has a hand on the steering wheel. If we steer effectively, early

offtake agreements need not translate into a free-for-all in the market. In the right market

context, they can instead serve as an invitation to high-quality supply and a recognition that a

collective mindset of learning-by-doing and transparency is the fastest way forward for ERW.

Footnotes